You might be thinking to yourself, “How much should I invest in my 401k….? Well, the more I invest, the better, right?”

Nope. Not necessarily. And that leads us into point #1…

1) You Should Invest Nothing When…

…You still have consumer debt

If you still have:

credit card debt,

car loans,

student loans,

medical debt, or

basically any debt other than a mortgage…

… I would tell you NOT to put any money into your 401k.

Why?

Because of the power of focus.

When people put…

a little bit of money toward their 401k,

a small amount to their credit card bill,

another few bucks at their furniture loan, and

yet another payment toward their car…

…they’re really getting themselves nowhere.

Why?

Because they’re driving toward absolutely nothing…When people try to juggle all the bills of their past AND invest for their future, they typically end up in their 50’s with about $10,000 in their retirement and they still have all those ridiculous debts hanging around.

Instead of trying to do everything at once and getting nowhere, do yourself a favor and focus on getting out of debt AS QUICKLY AS POSSIBLE. The fact that you’re investing nothing in your 401k might just scare you into ditching your debt in record time. Once you get out of debt (most do it in under two years), then should you invest in your 401k? Absolutely.

Related: How the Debt Snowball Really Works (and a FREE Tool For YOUR Debt Snowball!)

…You don’t understand what you’re investing in

People know they should invest…so they do….

…by closing their eyes,

putting their finger on one of dozens of options, and

then putting all their money into something they don’t understand.

This is just stupid. Investing really isn’t that hard. Take note of what’s offered through your company, read the descriptions, then read the related article below. After that, make an informed decision and choose your funds with confidence.

If you still don’t know what you’re doing, you’re not ready to invest.

Not sure where to start?

Get some inspiration from our detailed guide on the best way to invest $1,000. We'll talk you through the different investment types and assets, as well as where you can get started.

2) You Should Invest 5-10% When…

…You get a wicked awesome match from your company

How much should you put into your 401k? Well…If you work at ConocoPhillips where they contribute 6% after your mere 1% contribution…you might not need to invest all that much…

I currently work for a company that matches dollar for dollar up to 4% of your income, and then they contribute an additional 4% just because they’re wicked-awesome. Sooo, if I put in 7%, get a 4% match, and they put in another 4%, my total contribution totals 15%. Yup. That sounds good enough for me!

If you’re fortunate enough to get a match that’s out of this world, then you probably don’t need to invest the typical 15% that most financial gurus suggest.

…You’re young and want to retire early

If you’re 24 years old and are investing 25% of your $60,000 income (with the help of that match perhaps), you’ll likely have $2.5 million by the time you’re 55 years old… Time to retire early!! Oh wait…you can’t take the money out of your 401k until you’re 59.5 years old without being penalized… womp wommmmm.

Don’t be the sucker that has to stay and work when you’ve got plenty of money to retire. Instead, invest 10% or less into your 401k, then invest some more money in a regular brokerage account or invest in real estate! Once you have enough money to retire at age 50, you’ll be glad you did.

How much money should you put into your 401k? Only as much as you’ll need from age 60 to your death. 🙂

…You already have a ton of money saved up

Let’s say you’re 35 years old and you’ve been investing heavily in your 401k since you were 22. Today, you’ve got $250,000 in there. Keep contributing heavily and you’ll have $3.9 million by the time you’re 60. That’s a little excessive… It would be fine if you dialed that back a little and decided to actually live life for a change… 😉

3) You Should Invest 15% When…

…You’re on track with your saving

If you’re out of consumer debt and you’re on track with your retirement savings, then you should continue to invest at 15% of your income.

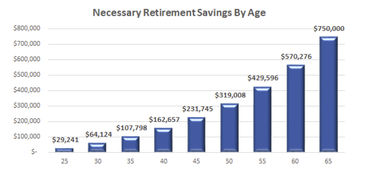

Not sure if you’re on track? Take a quick peek at the chart below:

According to this visual, one can quickly see how much they should have saved for their retirement based on their current age.

If you’re 30 years old, you should have $64,000 saved for retirement.

If you’re 55, then you should have $429,000 in your accounts. Etc. etc.

Are you close to the numbers above? Then continuing to invest 15% of your income should keep you on track!

*This chart assumes you’ll want to live on $45,000 (today’s dollars) a month in retirement and that your investments will earn an average of 8% each year.

…You don’t plan on retiring early

Do you love your job? Do you hate the idea of retiring early? Then it really doesn’t matter to you if you have $5 million socked away in an account that you can’t touch until you’re 59.5 years old. Even if you’re ahead of the game, you may as well just keep loading up that 401k account!

…You want to save for kids’ college

Were you thinking about investing more than 15% of your income? Don’t forget about those little ankle-biters — they’re going to want to go to college someday. So, instead of piling more money into your 401k account, you’ll probably want to max out at 15% and then stash some cash into a 529 account (an education investment account that grows tax-free).

…You have a home mortgage

The financial gurus will tell you to keep your home mortgage for as long as you possibly can.

They’ll tell you:

It is a great tax deduction

That you’re better off investing in the stock market than paying off your house

It’s okay to have a mortgage in retirement

Personally, I don’t fully agree with any of these statements.

When I was younger, I:

Paid off all my consumer debts

Aggressively paid off my home mortgage in less than a year

And now, my wife and I invest roughly 2/3 of our income for retirement, our kids’ college expenses, and for future fun

If you have a mortgage and want to put more than 15% away into your retirement accounts, I would urge you not to. Instead, max out at the 15%, then put the rest of your focus on paying off your house as fast as possible. Once you’re mortgage free, you’ll never regret this decision.

How much should you put into your 401k? …15% – then use the rest to pay down your home mortgage.

4) You Should Invest More Than 15% When…

…You’re way behind where you should be

If you took a look at the “Retirement Savings by Age” chart above and had a little dry-heave because you’re so far behind, then you might be in the camp where you invest more than 15% of your income. However, if you have a mortgage and consumer debt, I would still challenge you to pay that off first.

Now that you know you’re eons behind, it’s time to:

take on an extra job,

start your own business, and

live on far less than you make until you get yourself ahead again!

…You don’t want to hand all your money over to Uncle Sam

Earlier this year, my wife and I flipped a house and made $27,000. This was great and all…until I figured out how much it was going to mess up our taxes… Instead of just forking over $8,000 to the great Uncle Sam, I decided to:

Up our 401k investment to 30%, and

Max out our HSA account

By investing far more than 15% of our income (thereby reducing our taxable income for the year), we were able to reduce our tax bill to practically nothing.

When I asked myself, “How much should you invest into your 401k?”…my answer was, “Enough to keep everyone else’s grubby hands off our hard-earned money!!”

…You want to be the Rockefeller of your family

This is by far the coolest reason to invest more than 15% of your income. At this point,

you’re out of consumer debt,

you paid off your home mortgage,

and now you’re stashing cash away like you would have never thought possible.

Why?

To be a HUGE blessing to all your kids and grand-kiddos.

Just think. If you had invested from a young age and now have $250,00 at 35 years old, how much more could this grow to if you contribute half of your income – say…$3,000 a month (stop rolling your eyes. People without debt do this all the time!)??

Guess how much you’ll be worth at age 80:

$32,000,000 (that’s right, that says 32 million)

What if you could keep this going until age 100??

Then you’d be worth $185,000,000

Holy Toledo!! Sorry, Ohio, I just took your beloved city’s name in vain. But seriously….$185 million???

If you had 4 kids and 12 grandkids – you could leave them each $11,500,000. Whoa. Now THAT would change your family tree!

And you know what? If you’d rather leave the majority of your money to charity instead of to your family, you could do that too. You’d definitely still make a HUGE impact in the world!

How Much Should You Put Into Your 401k? Your Question Answered.

Before you stumbled upon this article, you were asking the question, “How much should you put into your 401k?” We just covered twelve possible life situations and preferences, which likely answered the question for 99% of you. BOOM!

So what about you? Based on the points above, how much should YOU put into your 401k?

.jpg)

.jpg)