Student loan forbearance is ending in August, and students are freaking out. Based on our recent survey, 50% of student loan borrowers don’t have enough money for their monthly payments.

What will they do? How will they make their payments? Will this pull down the entire economy? Or is this all just hype?

Between the results of our extensive survey and the opinions of subject matter experts, we’ve got a starkly different perspective on the student debt crisis.

The average and median student loan totals and monthly payments.

The likelihood of student loan default.

The student response and likely impact of student loan forgiveness.

Read more:

The Student Response: Results of the Survey

We surveyed 1,021 student loan borrowers.

The average student loan debt among these respondents was $26,733, with payments averaging $443 per month. The mean annual salary among them is $59,172.

When asked how they would afford their student loan payments, only 22% said they had been planning for payments to start up again, and they were ready.

Another 28% said they could make the payments by cutting back on expenses.

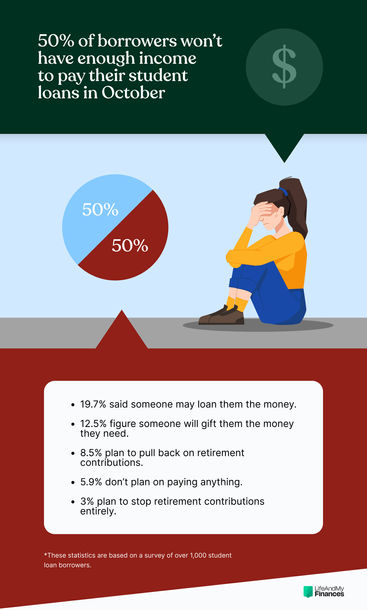

But half of student loan borrowers didn’t have the money to pay the debt themselves:

19.7% said someone might loan them the money.

12.5% figure someone will gift them the money they need.

8.5% plan to pull back on retirement contributions.

5.9% don’t plan on paying anything.

3% plan to stop retirement contributions entirely.

And when everyone was asked if student loans were causing them to worry about the future, nearly 70% of them said yes.

These numbers aren’t painting a rosy picture of the student loan situation we’re in right now, and they’re consistent with what we’ve been reading.But is the situation really as dire as it seems?

As we dive into the detail of our survey, we’re not so sure—

The Reality of the Student Loan Situation

First, let’s reiterate that this survey is of just over 1,000 people.

We won’t pretend that this minuscule poll will unveil the entire truth of the student loan debt crisis.

But with this genuine survey, we’ve started seeing patterns in the data that aren’t widely discussed.

And when we dig deeper into the well-known government loan reports, we can, in fact, confirm the validity of our data.

So what is the reality of the student loan crisis?

It’s not as bleak as you might think—

94% of student loan borrowers will not default on their loans.

The majority of students graduate with student debt of $20,000 or less.

The typical payment isn’t $500 a month or more. It’s closer to $250.

50% of respondents don’t have the money for student loans, but only 6% will default

Our student loan survey discovered that 50% of borrowers were unable to make their monthly payments with their typical income.

Similarly, a recent survey by U.S. News reported this number at roughly 40%.

Here’s the thing, though. While most of these individuals can’t make the payment themselves, they still have a plan to pay the bills:

They’ll borrow money from family and friends.

Some will get a gift to wipe out their student loans entirely.

Others will pull back or stop retirement contributions (not ideal, but at least they’re able to make their payments).

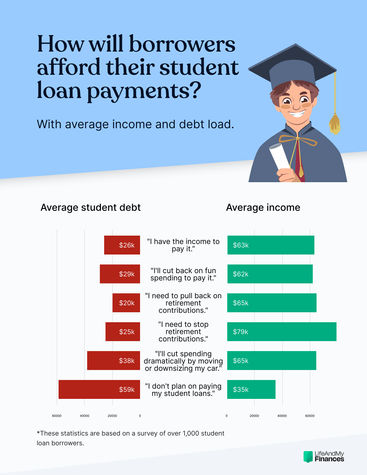

Our analysis showed that only 6% of individuals plan to default on their loans (vs. a reported average of 7.1% by Education Data).

And the reason is clear—

Most borrowers have a salary that’s twice their total student debt (roughly $65,000 vs. a student loan debt of $25,000).

It’s a manageable debt load.

Our study found that the average individual headed for default is earning just $35,000 and has student loan debt of $58,600.

History and psychology are the most popular degrees among those headed for default, contributing an average debt of $83,000 with a mean annual income of just $30,600.

This is certainly an uphill battle to climb. But remember, this is the minority of borrowers (just 6%).

The average student loan debt is $26,733, but the median is $17,500

According to U.S. News, in their annual survey of over 1,000 colleges, graduates who took out student loans en route to a bachelor’s degree borrowed an average of $29,719.

Education Data reports that the average student debt balance is a mind-blowing $37,717.

We’ve got to be careful with this information, though. Those numbers are averages, which can be skewed by outlying data.

According to our survey—

65% of borrowers have a student loan balance of $20,000 or less.

27% have student debt between $20,001 and $60,000.

Only 10% of borrowers have student loans of $60,001 or more.

If you lined up the student loans from smallest to largest and chose the middle one (the median), it would be just $17,500.

The Federal Reserve confirms this by reporting the median borrowing at just $20,000 vs. their reported average borrowing of $37,717.

How can this be? How can the median student loan be just $20,000 when the average is $30,000 or more?

The answer lies within the 10%.

Some students are taking on far more debt than they should. They’re severely ticking up the average and likely have no way to pay back their debts.

Of our 1,021 participants, only 100 of them had student debts of $60,001 or more:

65 had loans between $60,001 and $100,000.

30 had student debt between $100,001 and $200,000.

Two had loans between $200,001 and $300,000.

Three more had student loans of $300,001 or more.

The students with $100,000, $200,000, and $300,000+ student loan debts are inflating the averages severely—but they only make up 3% of all student loan borrowers.

The average monthly payment is $443, but the median monthly payment is $250

Education Data says the average monthly student loan payment is $503, similar to our survey findings of $443.

Sounds pretty huge, right? But it’s the same story as the above.

It’s the average—and it’s inflated by those that are borrowing hundreds of thousands of dollars.

We found that the median student loan payment is $250. This number is confirmed by The College Investor, reporting the median payment at $222.

This means the majority of borrowers are paying $250 or less a month for their student loans.

And, as our survey shows, just 11 of these 530 individuals are expected to default on their student loan payments.

That’s a meager 2% vs. the expected 6% default rate.

Most student loan borrowers are not in trouble.

The alarming numbers only come into play for the upper tier of borrowers—the 10% with $60,001 or more in debt.

Of these 100 individuals, 24 don’t plan to make their payments and will likely default on their loans (that’s a 24% default rate).

What can we learn from this?

The issue isn’t widespread. It’s centered around those that over-borrowed and now can’t afford the payments.

Student Loan Forgiveness: Is It Wanted? Will It Help?

If someone came up and offered to give me $10,000, no strings attached—I’d take it.

And I’m encouraging students to pay the minimum on their student loans as the Biden Administration continues to push for student debt forgiveness via every possible avenue.

What do borrowers think about debt forgiveness?

Unsurprisingly, out of our 1,021 respondents, 95% of them believed the government should forgive at least a portion of student loan debt.

When we asked why, this is what they said:

The government gave businesses a free handout. They should give money to student loan borrowers too. (42.2%)

The economy will collapse (or at least will be severely impacted) if they’re not forgiven. (25.7%)

It’s not fair that money was so freely handed out without students really understanding what they were getting themselves into. (18.7%)

College is ridiculously expensive, and the government should pay for it. (11.0%)

Will the student debt forgiveness program really help those that need it?

The majority of students have less than $20,000 in student loans—and most of them intend to (and are able to) pay them back.

A gift of $10,000–$20,000 would be amazing, but as our survey found (along with all the reputable sources we mentioned above), they weren’t going to default on their loans, anyway.

Remember those that were likely to do so? Their average annual income was $35,000, and their total student loan debt was nearly $60,000.

Will $10,000 keep them from defaulting? Not likely.

What’s the Issue? How Do Some Borrowers Get Into the Situation They’re In?

In the survey, we asked, “If you could do it all over again, would you borrow less money for college?”

Over 86% said yes.

Lawrence Sprung, the author of Financial Planning Made Personal and founder of Mitlin Financial, had this to say about the student loan crisis:

We need to fix the system. Forgiving $20,000 in debt will help some but not prevent this debt from continuing to balloon.Lawrence Sprung, Founder of Mitlin Financial

And who is at fault? According to Lawrence:

Colleges—for being “marketing machines looking to boost enrollments and their bottom lines.”

The government—for “giving out money for student loans at alarming rates.”

Parents—“for allowing their kids to enroll in schools that may not be the best fit.”

He continued, “The education decision needs to be one based on the return on investment, not where the most sunshine is, the best football team, or the social environment. Not one of these alone is responsible for where we are today, but collectively they have destroyed the financial lives of young adults everywhere and this needs to be addressed and changed.”

What Happens to the Students Who Can’t Pay?

As we already mentioned, our survey and other recent reports show that 6%–7% of student loan borrowers are headed for default.

What students think will happen if they can’t pay their student loans

We asked over 1,000 student loan borrowers what they thought would happen if they failed to pay their federal student loans.

Here’s what they said:

36.1% said the loans would go to collections.

29.5% said they’re not worried about it because they still believe student loans will be forgiven.

10.9% believe nothing would happen.

9.3% thought the government would garnish their wages.

7.5% said you’d go bankrupt.

5.9% admitted they didn’t know.

What will really happen if you don’t pay your student loans

We asked Robert Farrington—America’s Millennial Money Expert®—what really happens if you can’t pay your student debt:

If borrowers don’t pay their student loans, it’s probably one of the worst financial decisions a person can make.Robert Farrington, Founder of The College Investor

He laid out the below cadence for what happens if you don’t pay your student loans:

You’ll start seeing late fees and accrued interest after 30 days.

Your late payment gets reported delinquent to the bureaus after 90 days. This will impact your credit score.

You’re officially in default after 270 days.

“One thing borrowers need to know about federal loan collections is that the government has a lot of power to garnish your income if you are in default. After 270 days, any government payments are subject to offsets (garnishments). This includes paychecks if you work for the government, tax refunds (they can take all of it), and even disability or Social Security payments,” he clarified.

Additionally—

You could be brought to court for your non-payments.

You’ll lose eligibility for Federal Student Aid benefits, which means you can’t apply for federal deferment or income-driven repayment plans and won’t be eligible for future aid or grants.

Student Loan Programs That Can Help Those Facing Default

Farrington provides a bit of hope for those that don’t yet know how they’ll make their student loan payments, “With payments set to resume in October, the government is offering a pretty generous grace period to get started. They are going to allow a 90 day safety net period after payments restart, with the potential to extend that again another 90 days. That means if you do miss your first payment in October, your credit shouldn’t be dinged.”

Other helpful student loan programs are on the way

In addition to the helpful programs mentioned above, the Education Department is creating two other programs to help borrowers:

A temporary 12-month on-ramp repayment program that removes the threat of default should borrowers miss payments starting in October.

A new income-driven repayment plan that the administration calls “the most affordable repayment plan in history.”

Based on the press release from the U.S. Department of Education, you cannot be in default to qualify for the new income-driven repayment plan.

Also, the regulations will amend the terms of the REPAYE plan to offer:

$0 monthly payments for each individual earning less than roughly $30,600 per year (or less than $62,400 as a family).

Monthly payments are to be cut in half on undergraduate loans for borrowers who don’t have a $0 payment.

These regulations would ensure that borrowers stop seeing their balances grow due to accumulating interest.

What Should Borrowers Do if They Can’t Make Their Minimum Student Loan Payments?

Based on the survey, many are already taking the appropriate steps to get their student loans paid.

They’re cutting back on entertainment and big expense items where they can—and even reaching out to friends and family for help if needed.

But what else can students do if the student loan payments are too big to handle?

Contact your student loan servicer to explain your situation and discuss all your options.

Don’t miss potential debt forgiveness programs.

Use the student loan debt snowball spreadsheet (free Excel download) to line up your debts and make a payoff plan. (Don’t have Excel? Here’s the Google Sheets version.)

Change your repayment plan to an income-driven repayment plan. (Here are all the current repayment options.)

Consider consolidation, deferment, or forbearance.

Key Takeaways

50% of students can’t afford their student loan payments with their discretionary income, but only 6% will default.

The average student loan balance per borrower is roughly $30,000, but the median student loan is $20,000 or less.

The average student loan payment is roughly $500 per borrower, but the median is $250 or less.

Our survey shows that only 10% of borrowers have $60,000 or more in student loan debt.

While many borrowers would love the $10,000 or $20,000 of debt forgiveness, it likely won’t have a significant impact on those facing default.

.jpg)