Imagine a world where your debts melt away faster than you thought possible. That's the power of the debt avalanche method – a strategy so effective, it turns your financial burdens into a snowball of success.

The debt avalanche method lets you focus on your most expensive debts first. You clear them and reduce your overall debt quicker.

Let’s get stuck in.

How to Kickstart Your Debt-Free Journey

Ready to slash your debt fast? Here's how! To get started with the avalanche method, you need to line up your debts – highest interest rates take the front row.

You’ll always tackle the debt with the highest interest rate first. This way, you won’t only pay off what you owe. You’ll also save money in interest. At the same time, keep chipping away at smaller debts with minimum payments while you conquer the giants.

Victory over one? Onwards! Next up, tackle the debt with the next steepest interest. Rinse and repeat until you're basking in the glory of a debt-free life.

How to Kickstart Your Debt-Free Journey

Getting started is easy with our debt avalanche spreadsheet. Start clearing your debt now.

Get your bills together

For the avalanche method to work, you need to know how much you owe and how much interest you’re paying. Get your bills and bank statements together so you know exactly how much you’re paying towards your debts each month.

Start a spreadsheet

We’ve made this step easy. Download our debt avalanche calculator to record your debts, the minimum payments due on them, and their interest rates. Add the amount you can afford to put towards clearing your debts, and the calculator will do the rest for you.

Make monthly payments

When you’ve organized your debts, start making monthly payments toward the one with the highest interest rate.

Timing is Key: Knowing When to Unleash the Debt Avalanche

The debt avalanche method works best when you’ve got multiple high-interest debts that need clearing. The quicker you get rid of the highest interest debts, the more money you’ll save. Simple.

Ready to start your debt avalanche?

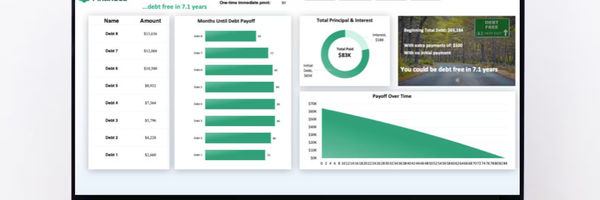

Simply enter your debts and the spreadsheet will map out your journey to debt freedom! Charts and graphs will help you visualize your progress and keep you motivated!

Unlock Savings: The Financial Magic of the Debt Avalanche Method

Because the debt avalanche method clears your highest interest debts first, it’ll save you money in the long run.

Let’s work it through.

Imagine you have two debts. One is of $10,000, with a 26% interest rate and a minimum payment amount of $50 per month. The other is a debt of $5,000 at a 10% interest rate, with a minimum payment amount of $30 per month. You can afford to put $380 towards clearing your debts each month, in total.

If you clear the $5,000 debt first by paying $330 on it per month, it’ll only take 1 year and 4 months to clear. You’ll pay a total of $276 of interest on this debt, saving yourself $3,180 of interest compared to if you’d paid it off with minimum payments.

However, you’d only be paying the minimum amount towards your $10,000 debt for this time. It would take a total of 6 years and 3 months to pay off your $10,000 debt, and you’d pay $11,237 of interest on it during this time. That makes $11,513 of interest payments in total.

If you started with your $10,000 debt, it’d take 3 years and 6 months to pay it off with $350 per month. However, you’d only pay $4,699 of interest. Meanwhile, your smaller debt of $5,000 would take 4 years and 10 months to pay off, but you’d have paid only $2,109 of interest on it, making a total of $6,808 of interest payments.

By starting with the higher debt, you’d have saved yourself a whopping $4,705.

Fast Track to Freedom: Learn to Speed Up Debt Clearance

If used correctly, the debt avalanche method can help you clear your debt in under a year. But, its success depends on how much debt you have and how much you can afford to pay off at once.

Like we said in the example above, the debt avalanche method can help you clear your total debt more quickly than focusing on smaller debts. The difference may seem small. In the first example, focus on the small amount first. Your total debt is cleared in around two and a half years.

If you use the avalanche method, your debt should clear in 2 years and 5 months. This will give you an extra month without debt. You may also be able to pay off your debts sooner. If you can afford to, make any additional lump-sum payments during your payoff.

Personalize Your Debt Plan: Tailoring the Debt Avalanche for Maximum Impact

The debt avalanche method needs discipline, determination, and realistic goals. Set a minimum payback amount aside each month so you know exactly how much you’re going to have after you’ve been paid.

It might also be a good idea to put this amount towards your debt near the beginning of the month. This can minimize the chances you won’t have enough to reach your minimum by the end of the month.

Exploring Alternatives and Different Paths to Conquering Debt

The debt avalanche method can save you more money in the long run. However, focusing on high interest debts first can be daunting. If you don’t think this method is for you, try some of the methods below.

The debt snowball method

This is similar to the debt avalanche method. However, it focuses on paying off your smallest debts quickly. This can be good for giving you a positive mindset and a boost to your mental health. You’ll be able to clear some of your debt more quickly.

Be careful though. The debt snowball method will reduce your debt. However, in the long run, you’ll end up paying more interest than with the debt avalanche method.

But if quick wins are your priority, you can start your own debt snowball with our spreadsheet for Excel or Google Sheets.

Debt consolidation

You can take out a debt consolidation loan to consolidate your debts into one payment. This can be useful if you have lots of high-interest credit cards that all need to be paid off.

A balance transfer credit card

Balance transfer credit cards have the benefit of 0% interest, but they usually come with a fee. If you have a good enough credit score, you might be able to transfer your credit card debt to a balance transfer credit card. If you pay the debt off during your introductory period, you’ll pay no interest.

Stay Ahead: Proven Strategies to Keep Debt at Bay

Good question! It’s difficult to manage your finances at the moment, prices keep rising, so your wages often won’t go as far as they used to.

The best way to avoid falling into debt again is to start a budget. This helps you see exactly how much you’re getting paid each month, and how much you need to spend on essentials. When you’ve worked this out, you can allocate the rest of your wages to entertainment and other fun things, and make some deposits to your savings.

Your Financial Toolkit: Download Our Essential Budget Spreadsheets

We have budget spreadsheets that can help you plan your spending on a weekly or monthly basis. Check them out and avoid falling into debt again.

.jpg)

.jpg)

.jpg)