Definition

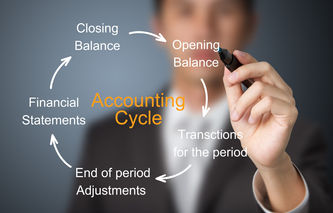

The financial accounting term adjusting entry refers to the modifications made to certain accounts before a financial statement is produced. Adjusting entries are an essential part of the accounting cycle for companies that use accruals to match expenses with revenues in any given accounting period.

Explanation

The accounting cycle calls for adjusting entries to be made near the end of each financial reporting period. The adjustments consist of accruals to various expense and revenue accounts to ensure the matching of costs and revenues in the company's financial statements.

These changes occur prior to posting entries in the general ledger. The two most common adjusting entries involve:

Prepaid Items: an expense that is recorded in advance of its actual consumption; part of the prepaid item may be used in the current period, while the unused portion would remain an asset of the business.

Accruals: an expense incurred in the current period, but not yet invoiced by the provider or paid by the business.

Adjusting entries can also be made for depreciation, bad debt, assets, liabilities and / or any other estimated cost or revenue source. Later in the accounting cycle, reversing entries are made to counteract the effects of these adjustments. When new or better cost / revenue information is obtained, these final entries are used to settle an account.

Example

Company A has entered into a time and material agreement with Company B to restore a walk in center. During the last week in January, Company B provides an estimate of $75,000 to Company A for work through month end.

Since Company A has not yet received an invoice for the work, they accrue an expense of $75,000 in the month of January, which is the adjusting entry. As part of the accounting cycle, on February 1, the accrual reverses itself, providing a credit in the expense account; this is the reversing entry.

On February 15, Company A receives an invoice from Company B of $76,000 for the work completed in January. Company A would then debit the expense account for $76,000, thereby booking a net expense of $76,000 (actual expense) - $75,000 (accrual) or $1,000.