You can use this calculator to help you compare the cost of buying a new car versus leasing a car. The calculator takes into consideration factors such as the depreciation in value of each car, the capitalized cost reduction or down payments, and how long you want to own the car. Using this type of information, the calculator determines the monthly and total cost of ownership (TCO) for buying versus leasing a car.

Inputs

Additional Lease Costs

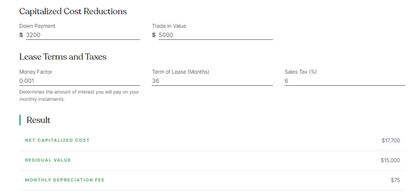

Capitalized Cost Reductions

Lease Terms and Taxes

Result

| Net Capitalized Cost | $17,700 |

|---|---|

| Residual Value | $15,000 |

| Monthly Depreciation Fee | $75 |

| Monthly Lease Fee | $32.70 |

| Monthly Sales Tax | $6.46 |

| Total Lease Fee | $1,177.20 |

| Monthly Lease Payment (Excl. Tax) | $107.70 |

| Monthly Lease Payment (Incl. Tax) | $114.16 |

Calculator Definitions

The variables used in our online calculator are defined in detail below, including how to interpret the results.

MSRP of Car ($)

The MSRP is the manufacturer's suggested retail price of the car. The MSRP is the basis for the calculation of the market value of the car if you're buying the car, or the residual value of a car for a lease.

Negotiated Price of Car ($)

This is the purchase price of the car that you have negotiated with the dealership. This figure should include all rebates and other costs associated with the purchase, except for down payments or capitalized cost reduction payments.

Sales Tax Rate (%)

This is the sales tax rate for your state. When you buy a car, sales tax is due at the time of purchase. In a lease, sales tax is collected in your monthly lease payments.

Term of Lease and Loan (Years)

The term of the loan is the number of years over which the loan will be paid or the lease will exist. To make a completely fair comparison for a lease versus buy decision, the term should be the same. Common lease terms are 2, 3, and 4 years.

Down Payment ($)

If you are lowering the amount you're going to finance by providing a cash down payment, then enter that amount here.

Annual Interest Rate (%)

This is the annual interest rate on the automobile loan. This is not the APR, which takes into account other costs associated with the loan.

Acquisition Fee ($)

Acquisition fees usually range from $250 to $750. This fee is included in every lease agreement.

Capitalized Cost Reduction ($)

The term capitalized cost reduction for a lease is very similar in concept to a down payment when buying a car. Capitalized cost reduction payments serve to lower the monthly lease payments by providing a payment of money up front.

Residual Value (%)

The residual value is simply the value of the car at the end of the lease. In this calculator, the residual value is also used to determine the market value of a car if you buy it. Residual values of cars will vary, however, average residual values include: 1 year old car (77%), 2 year old car (65%), 3 year old car (56%), 4 year old car (48%) and a five year old car (41%).

Money Factor

Car leases use a Money Factor in place of an interest rate on a loan. In fact, if you take the money factor and multiply it by 24, you get the effective interest rate on the lease.

Sales Tax ($)

This is the sales tax due on a car at the time of purchase. In this example, the sales tax is rolled into the net amount financed.

Net Amount Financed ($)

The net amount financed is calculated by taking the purchase price of the car, subtracting down payments, and adding in the sales tax.

Monthly Payment ($ / Month)

This is the monthly payment necessary to repay the car loan over its lifetime.

Total Loan Payments ($)

The total amount paid to the bank or lending institution over the life of the car loan when buying a car.

Total Payments ($)

This is the total of all payments due when buying a car; this includes the total loan payments plus any deposits.

Market Value of Car ($)

This is the market value of the car when the term of the loan has expired. The market value is based on the residual factor entered for a leased car.

Total Cost of Ownership ($)

This is the total cost of ownership (TCO) for the vehicle over the time which the car was owned. This is calculated by taking the total payments and subtracting the market value of the automobile.

Cost of Ownership ($ / Month)

This is simply the total cost of ownership divided by the months the car is owned or leased.

Net Capitalized Cost ($)

The net capitalized cost is determined by taking the negotiated price of the car and subtracting out any capitalized cost reduction payments.

Residual Value ($)

This is the residual value of the car at the end of the lease. The residual value is used to calculate the car's depreciation costs.

Total Depreciation ($)

This is the total depreciation costs for the vehicle. One of the costs that need to be recovered in a car lease is the depreciation.

Finance or Rent Charge ($)

The finance or rent charges is the second cost that needs to be recovered in a monthly lease. This is the rent charged for financing the car.

Monthly Lease Payment ($ / Month)

This is the total monthly lease payment for the car.

Total of all Lease Payment ($)

The total of all lease payments is calculated by multiplying the monthly lease payment times the number of months in the term of the lease.

Total of Lease and Upfront Costs ($)

This is the total cost of the lease, it includes the total of all lease payments plus the capitalized cost reduction payment.

Cost of Ownership ($ / Month)

This is the total cost of ownership for the lease, and this is the value you'd use when making a lease versus buy comparison.

Disclaimer: These online calculators are made available and meant to be used as a screening tool for the investor. The accuracy of these calculations is not guaranteed nor is its applicability to your individual circumstances. You should always obtain personal advice from qualified professionals.