There’s a radical new generation of investors who aren’t content to simply follow the example of their parents’ generation. The economy, technology, and opportunities available have quickly evolved over the last decade—and so have the goals and priorities of younger investors.

Millennials are having a growing impact on financial markets. They’ve made their presence felt through the rise of meme stocks and cryptocurrencies—and now they’re bringing the revolution to the art market as well.

Want to know more about the world of art shares?

Masterworks is a leader and innovator in this field. Read our independent review to find out how they're democratizing art shares and whether Masterworks could boost your portfolio.

Millennial Motivations: Shifting Ideals

Millennials have a different attitude to investing from previous generations. EY found that their younger clients had a higher risk appetite, greater demand for digital solutions, and greater interest in ethics and sustainability.

Witnessing the effects of a climate crisis and an unequal and broken economic system has left millennials more radical than previous generations were at the same age.

So perhaps it’s not surprising that millennials don’t have the trust or patience to follow the conservative investment strategies of their forebears. They’re on the hunt for accessible opportunities that require a small investment but have a chance to offer faster and larger returns than traditional assets.

In fact, a Bank of America study found that while investors over 42 were allocating more than half of their portfolio to stocks, the younger generation held just 25% in stocks. Millennials also held more than three times as many alternative investments.

From GameStop to Banksy: Why Investors Are Putting Stock in Art

Many investors of previous generations simply placed their faith in the stock market to deliver decent returns. So what is prompting younger investors to turn to the art market?

Price Appreciation

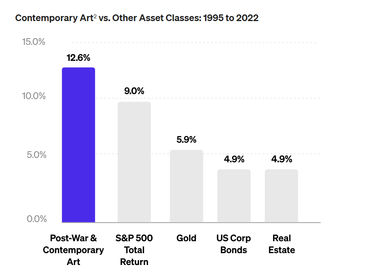

Unsurprisingly, a key reason millennials are considering art is the opportunity to make a buck. According to research by Masterworks, the value of contemporary art increased by a compound annual growth rate of 12.6% between 1995 and 2022.

This means that during that period it outperformed the S&P 500 which returned just 9% annually.

Recession Protection

When the economy is booming and the stock market is a sea of green candles, stocks can certainly be an attractive investment. However, when a recession hits, stock investors get hurt.

The art market is less impacted by economic changes and can continue to deliver returns in recessions, as well as periods of inflation.

Diversification

Many art investors still hold stocks, but the reason they buy art as well is to diversify their portfolio. Art is an increasingly popular choice for diversification as it has such a low correlation with other major asset classes during periods of financial stress.

Ready to reap the rewards of art?

Masterworks is the easiest access point to the art market. Sign up and talk to their team of friendly experts for advice on making an investment. Masterworks offers shares in some of today's most profitable artists, such as Banksy and Basquiat!

The Art of Fractional Investing

Fractional art investing works much like other forms of fractional investing. An artwork is securitized, divided into shares, and those shares are sold to investors. The investors then own a fraction of the work, and when it’s sold, they’re entitled to a proportional share of the profits.

This suits many investors who don’t have the capital, knowledge, or resources to go solo as an art investor. Art shares provide them with a simple solution as they’re more affordable and the company that offers the shares will do the hard work of choosing, acquiring, storing, conserving, and selling the artwork.

Buying shares in artworks is a relatively new phenomenon. Overall, the adoption so far has been low—according to the Hiscox Online Art Trade Report 2023, only 9% of art buyers surveyed had bought art shares in the previous year. However, 78% of younger art buyers were interested in making a fractional investment in art in the coming year.

The vast majority are considering art shares as a means of diversification to protect their portfolio from an uncertain economic future. Three-quarters of respondents are drawn to fractional ownership as an easy access point to an asset class they couldn’t otherwise afford.

Digital communities are increasingly important to the younger generation. The Hiscox report found that 84% of young art buyers used Instagram for art-related purposes.

For those who are yet to dip their toes in the fractional art market, by far the biggest perceived risk is the lack of liquidity. The next most common concerns are the associated costs, market transparency, and the capability of the platform that manages the art on behalf of investors.

How To Grab a Piece of a Masterpiece

Access to art investments has never been easier thanks to the rise of fractional art ownership platforms such as Masterworks. Anyone can create an account and buy shares in Banksys and Basquiats for as little as $20 apiece.

Masterworks is working to mitigate the concerns around fractional art investing. Its huge user base, growing number of acquisitions, and secondary trading market mean Masterworks is providing more liquidity to the art market.

There are no upfront costs to investors and the platform aims to make its fees, process, and market research as transparent as possible.

Investors don’t need to be art aficionados as they can call Masterworks’ team of experts for advice at any time. Masterworks has some of the most respected research teams in the industry. They’ve compiled art market indices by analyzing millions of data points.

So whether you’re a connoisseur or a layperson when it comes to art, Masterworks makes it simple to diversify and strengthen your portfolio with art shares.

Want to add art to your portfolio?

Simply create an account with Masterworks and have a quick intro call to get to know the platform. They'll walk you through the whole process. With new artworks available each week, there's always something promising on offer to investors!

.jpg)