Definition

The financial accounting term bad debts expense refers to the portion of revenue a company does not expect to collect from customers. The Matching Principle dictates bad debts are recorded as an expense in the same accounting period in which the sale occurred.

Explanation

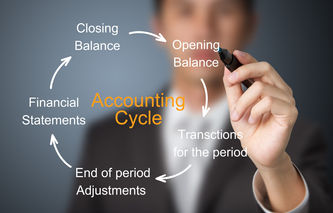

The Matching Principle is an accounting standard that states revenues generated in an accounting period need to be matched with the expenses incurred in that same accounting period. As part of the accounting cycle, an adjustment is made to lower sales by the anticipated amount of uncollected revenue.

Companies develop estimates of bad debts expense using a mix of actual (historical) data, prevailing economic conditions, and uncollectible aging information. Typically, bad debts expense is calculated as a percentage of sales revenue.

Bad debts expense is recorded as an adjustment to allowance for doubtful accounts, which is a contra asset that lowers the balance in accounts receivable (a current asset).

Example

Using two years of historical data, Company A has determined that write-off occurs at a rate of 2% of revenues. In the current accounting period, Company A's revenues were $1,000,000. The adjusting entry for bad debts expense is as follows.

Date | Account Description | Account Number | Debit | Credit |

06/30/20XX | Bad Debts Expense | 904 | 20,000 | |

Allowance for Doubtful Accounts | 419 | 20,000 | ||

Bad debt expense recorded in the current accounting period as 2% of $1,000,000, or $20,000 | ||||