"Will I have enough money to retire?....Or will I end up broke, surviving on dog food and spam?"

I joke about it, but this is a serious worry for 99% of us today, and why shouldn't it be?

Socking money away for retirement isn't easy, and it can get pretty complicated figuring out exactly how much our monthly contributions will grow into 40 years from now.

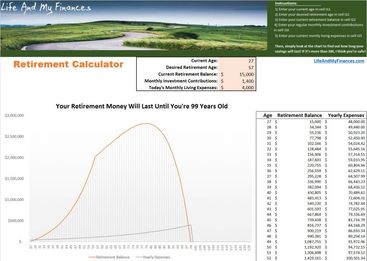

That's why I created this simple tool, "The Retirement Calculator".

Simply click the link and the calculator will download to your PC - you'll see it in the lower left-hand corner of your screen once it downloads.

Similar articles on retirement:

Will You Have Enough Money to Retire?

To figure out if your money will last through your entire retirement, you'll have to answer just five simple questions:

How old are you?

At what age do you want to retire?

How much money is currently in your retirement accounts?

How much do you contribute to your retirement funds each month?

What are your current living expenses?

Read more:

The first two are no-brainers. If you don't know how old you currently are or at what age you'd like to retire, I don't think anyone in this world can build a retirement tool simple enough for you.... so let's move on to the next questions.

How Much Is In Your Retirement Accounts?

This current amount doesn't have to be limited to your 401(k) account at your work.

If you have money invested with a brokerage likeWealthsimpleor Fidelity and it's earmarked for retirement, include that in the mix as well. Heck, even if you have equity in a real estate investment, I'd include that here too.

If it's an investment for your future and you don't plan on buying a boat with it between now and Tuesday, then put it into this calculator so we can see what it grows to and if it will last you throughout your retirement years.

How Much Do You Contribute to Your Retirement Funds Each Month?

If you're serious about saving for retirement, then you should most certainly be putting a set amount into your investment account each month. The absolute easiest way to do this is via a direct deposit from your paycheck.

This way, you'll never see the money, it won't hurt as much, and you'll be much more likely to keep your contributions going for decades.

So how much do you stash away into retirement each month? Be sure to include:

Your 401(k) direct deposits

Your Roth IRA contributions

Stock investments

If you have multiple investments that you're contributing to, it might be easier to calculate your average yearly contributions and then divide by 12 to figure out your monthly entry.

How Much Are Your Current Living Expenses?

When you total up your expenses each month, what's the typical total? $2,000? $3,000? Maybe $4,000?

Whatever the amount is, your expenses in retirement will likely be very similar.

Sure, you might ditch your house payment before you retire, but your medical expenses and insurance costs will be far higher in your elderly years than they are now. Inflation is another bugger you've got to watch out for.

I've captured it in my tool at 3% each year (you can find it in the far right-hand column if you're curious), so you don't have to worry about it biting you in the butt at retirement.

Are you in debt? Check out our debt snowballs spreadsheet to see how quickly you can get out.

So...Will You Have Enough Money to Retire?

If you haven't already, try out the tool and find out if you're on track for your retirement goals! If you're 50 years old and plan to retire at 55....but your money will only last till you're 62, then you might want to rethink your retirement date.

Either that, or you should figure out how to make bank between now and then (which can happen by the way, so don't give up).

.jpg)

.jpg)

.jpg)